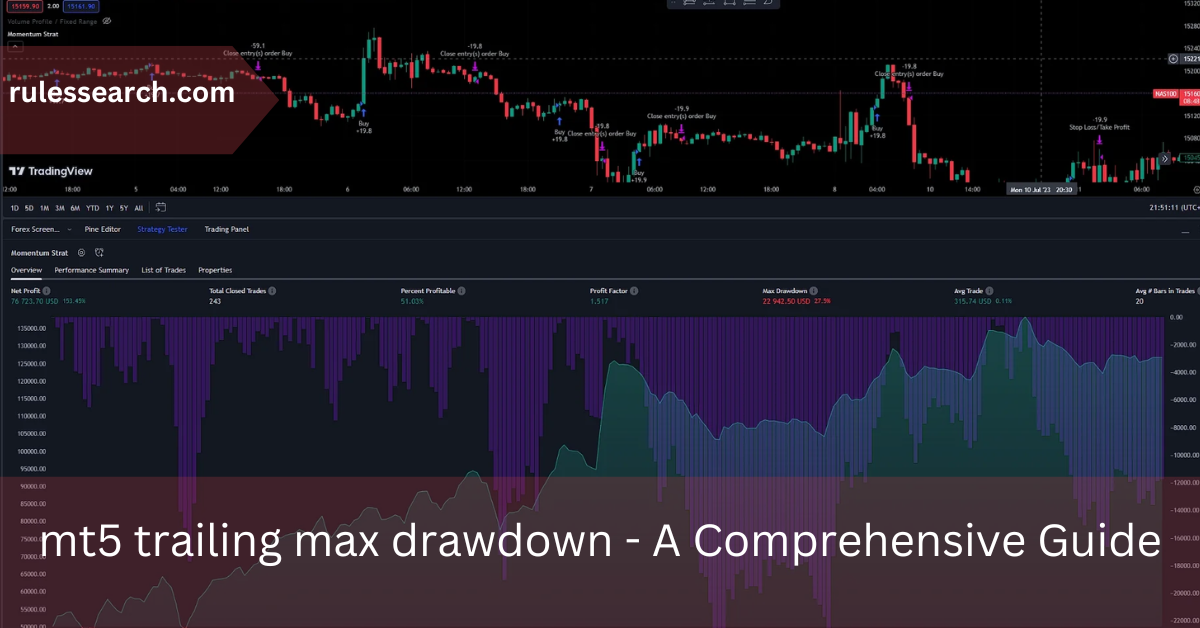

In the world of trading, managing risk effectively is crucial to maintaining long-term profitability. One powerful tool for risk management is the “Trailing Max Drawdown” feature in MetaTrader 5 (MT5). This guide delves into what trailing max drawdown is, how it works in MT5, and its benefits for traders.

What is mt5 trailing max drawdown?

mt5 trailing max drawdown is a risk management feature designed to protect trading capital by dynamically adjusting the drawdown limit based on the highest equity level achieved during trading. Unlike static drawdown limits, which remain fixed, trailing max drawdown adapts as your account balance grows, providing a more flexible approach to managing risk.

How Does mt5 trailing max drawdown Work?

When you use trailing max drawdown, the system continuously monitors your account’s highest equity point. If your account balance increases, the trailing max drawdown limit adjusts accordingly. If the account balance subsequently falls, the drawdown limit remains at the highest equity level previously reached, thus protecting your gains.

For example, if you set a trailing max drawdown limit of 10% and your highest equity point is $10,000, the trailing drawdown limit would be $9,000. If your equity grows to $12,000, the trailing drawdown limit adjusts to $10,800. However, if your equity drops to $11,000, the drawdown limit remains at $10,800, ensuring you retain some of your gains.

Benefits of Using Trailing Max Drawdown in MT5

Enhanced Risk Management

mt5 trailing max drawdown provides a dynamic approach to risk management. By adjusting the drawdown limit based on your account’s highest equity, it helps you lock in profits and minimize losses. This flexibility is particularly beneficial during volatile market conditions where static drawdown limits might not be as effective.

Preservation of Gains

One of the key advantages of mt5 trailing max drawdown is its ability to preserve gains. As your account balance increases, the trailing drawdown limit rises with it, ensuring that you retain a portion of your profits even if the market turns against you. This feature helps you avoid giving back substantial gains and protects your capital.

Reduced Emotional Stress

Trading can be emotionally taxing, especially when facing potential losses. mt5 trailing max drawdown reduces the stress associated with managing risk by automating the process. With this feature, you don’t have to constantly monitor your account or manually adjust your drawdown limits, allowing you to focus on your trading strategy.

Setting Up Trailing Max Drawdown in MT5

Configuring Trailing Max Drawdown

To set up trailing max drawdown in MT5, follow these steps:

- Open MT5 Platform: Launch your MetaTrader 5 platform and log in to your trading account.

- Access Risk Management Settings: Go to the ‘Tools’ menu and select ‘Options’ or press Ctrl+O to open the options window.

- Navigate to the Trailing Stop Settings: In the options window, go to the ‘Trade’ tab and locate the ‘Trailing Stop’ section.

- Set Trailing Max Drawdown: Enter your desired trailing max drawdown percentage. This percentage will be applied to your highest equity point to calculate the drawdown limit.

- Apply and Save Settings: Click ‘OK’ to apply the settings and save your configuration.

Monitoring and Adjusting Drawdown Limits

Once you have configured the trailing max drawdown, it’s important to monitor its performance regularly. Keep an eye on your account’s equity and ensure that the drawdown limit is adjusting as expected. If necessary, you can modify the trailing drawdown settings to align with changes in your trading strategy or risk tolerance.

Common Mistakes to Avoid with mt5 trailing max drawdown

Setting Unrealistic Drawdown Limits

One common mistake traders make is setting overly tight drawdown limits. While it’s important to manage risk, setting limits that are too tight can result in frequent stop-outs and missed trading opportunities. Ensure your mt5 trailing max drawdown limit is realistic and aligns with your trading strategy.

Neglecting Regular Monitoring

Even though trailing max drawdown automates risk management, it’s still crucial to monitor your account regularly. Market conditions can change rapidly, and failing to adjust your settings accordingly may impact your trading performance. Stay proactive and adjust your trailing drawdown limits as needed.

Over-Relying on mt5 trailing max drawdown

While trailing max drawdown is a valuable tool, it should not be the sole component of your risk management strategy. Combine it with other risk management techniques, such as diversification and position sizing, to create a comprehensive risk management plan.

Conclusion

mt5 trailing max drawdown offers a sophisticated and dynamic approach to managing risk. By adjusting your drawdown limits based on your account’s highest equity point, it helps you preserve gains and minimize losses. Understanding how to set up and utilize this feature effectively can enhance your trading strategy and improve your overall trading performance.

FAQs

What is the difference between static and mt5 trailing max drawdown?

Static drawdown limits remain fixed, whereas trailing max drawdown adjusts based on the highest equity point achieved during trading.

How do I set a mt5 trailing max drawdown limit in MT5?

Navigate to the ‘Tools’ menu, access ‘Options,’ go to the ‘Trade’ tab, and enter your desired trailing max drawdown percentage in the ‘Trailing Stop’ section.

Can mt5 trailing max drawdown be used in conjunction with other risk management tools?

Yes, trailing max drawdown can be combined with other risk management techniques, such as diversification and position sizing, for a comprehensive risk management strategy.

What happens if my account equity falls below the trailing max drawdown limit?

The trailing drawdown limit remains at the highest equity level previously reached, helping to protect your gains even if your account equity drops.

Is trailing max drawdown suitable for all trading strategies?

Trailing max drawdown is versatile and can be used with various trading strategies. However, it should be adjusted based on your specific trading style and risk tolerance.

How frequently should I monitor my trailing max drawdown settings?

Regular monitoring is recommended to ensure that the trailing drawdown limit is adjusting correctly and aligns with your trading strategy and market conditions.

Can trailing max drawdown prevent all losses?

While trailing max drawdown helps minimize losses, it cannot eliminate them entirely. It is essential to use it in conjunction with other risk management practices.

What is an ideal percentage for setting a trailing max drawdown limit?

The ideal percentage varies based on your trading strategy and risk tolerance. Consider setting a percentage that balances risk and reward while aligning with your overall trading plan.

Does MT5 offer other risk management tools besides trailing max drawdown?

Yes, MT5 offers various risk management tools, including stop loss, take profit, and risk/reward ratio settings, which can be used in conjunction with trailing max drawdown.

Can trailing max drawdown settings be adjusted during live trading?

Yes, you can adjust trailing max drawdown settings during live trading. However, ensure that any changes are carefully considered to avoid unintended consequences.